State of the Mineral Specimen Market

By Collector Barry Kitt

Originally published in The Mineralogical Record, volume 45, November–December, 2014 613

Issue available for purchase here

INTRODUCTION

Four years ago I began collecting minerals after visiting the Smithsonian, seeing the blue-cap tourmaline called the “Candelabra,” and finding its beauty and aesthetics stunning. A few months later I went to my first mineral show in Denver where, for the first time, I saw a large collection of beautiful minerals on display that were available for purchase.

After experiencing the show and seeing that many of the best of these beautiful, natural works of art were very pricey, I began to look for validation that this hobby was for real and that the prices were justified and not vastly inflated. It seemed logical that there must be some kind of association or group that I could turn to for at least a somewhat independent validation of the hobby and the dealers who were offering minerals for sale, and also some advice about how to learn more about minerals in general and how to become educated regarding valuations. Much to my surprise, there was no such association or group.

After returning home from the show and realizing that my interest in collecting minerals was not going to be a passing fancy, I began calling everyone that I had met in the hobby, including dealers and collectors, asking them if they felt that an association was a good thing or not. The results were mixed, but positive enough to make me want to press ahead with some kind of an effort. Since very few people in the mineral world knew of me, I asked Gene Meieran, who is known and respected by everyone in the mineral business, if he would consider leading the effort to form an association. You all know that eventually the Fine Mineral Trade Association (FMTA) was formed and funded enough to get off the ground. Since that time there has been little traction for the organization and its future is in limbo. Many collectors and some dealers would like to see such an organization find direction and become effective because they see it as supporting and lending credibility to the industry/hobby and leading to increased awareness and interest from new collectors.

Flash forward to late August when a fellow collector asked me what I thought “the real state of the union in the mineral business” was. I thought that I could simply answer the question to the best of my ability, but I decided instead to reach out to many of my friends in the mineral business, both dealers and collectors, and ask them the same question: “What is the real state of the union in the mineral business?”

Over the following few weeks I received many thoughtful comments. As I waited for the various replies to come in it occurred to me that the result of my informal and, admittedly, unscientific poll might be of interest to many mineral collectors and dealers, and especially to new collectors and to those who are considering collecting minerals. Then, coming full circle, it occurred to me that this is exactly the kind of information that one might expect a mineral association to provide. I am hopeful that one day our hobby will have a strong association that will, among other things, help get the word to potential collectors that collectible mineral specimens exist and that they range from fascinating scientific or historical objects to very desirable natural works of art. In addition to the established worldwide mineral shows, there are many fine mineral books, journals, magazines and other media, and there are numerous active mineral clubs in various states. More recent events that have been very helpful to the hobby/business in increasing the awareness of minerals among a greater number of potential new collectors include:

(1) The Dallas Mineral Collecting Symposium.

(2) The Heritage Mineral Auctions.

(3) Gail and Jim Spann’s open house events to share their fine collection.

(4) Establishment of the Lyda Hill Gem and Minerals Hall at the Perot Museum of Nature and Science.

(5) The Prospectors TV series on the Weather Channel.

(6) The new Denver Fine Mineral show.

(7) A new PBS series entitled “Mineral Explorers,” which has an eight-episode contract beginning in early January 2015.

(8) Morphy’s Auctions, which had its first mineral auction on November 8th.

(9) Christies Auction House, which may be conducting a mineral auction in 2015.

(10) Leslie Hindman Auctioneers, who had their first mineral auction on September 16th.

COMMENTS FROM DEALERS

Now for the results of my poll of 15 mineral dealers and 11 mineral collectors. The comments below are extracts from and summaries of their responses. Bear in mind that dealers have a vested interest in promoting the rosy future of the mineral market, but their intimate knowledge can offer useful insights:

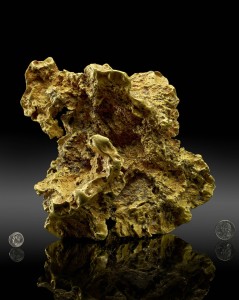

(Dealer 1) “The market has never been stronger, supply is diminishing, and new collectors are entering. This short equation is obvious yet does not tell the entire story. Top-level specimens are being sold to black-hole-style collectors who are partially responsible for driving the market at the highest end. Some are ‘investor collectors,’ but most are actually true hardcore mineral lovers. In large part it is because of these collectors that prices are rising and the supply is dwindling. The pieces they are acquiring will not re-enter the market for 10 to 30 years from today. Contributing to this dynamic, mining is down around the globe, with less production of fine specimens; Asia is minting billionaires faster than any other region; interest rates are still at record lows; and the US stock markets are at record highs. Where are wealthy individuals going to put their money? Collectibles and art are surely one place. If you look at the trend lines for fine collectibles, they have been increasing in value at a rapid pace: $38 million for a Ferrari, $10 million for a 1794 silver dollar, $9.5 million for a British Guiana stamp, $3.2 million for a Superman comic: the list is very long, and some of the best items have been regularly selling for millions of dollars apiece. Even another financial debacle such as we endured in 2008, which could slow this pace, would not change the fundamentals we have seen over the past decade. Simply put, the finest mineral specimens are scarce, more people desire to own them, they are no longer considered merely scientific but are now accepted as works of art, and prices will continue to rise.”

(Dealer 2) “[Prices are] stronger now than they have ever been in history, but still a far cry from where they are going.”

(Dealer 3) “We are in the ‘Golden Age’ of minerals.”

(Dealer 4) “[The mineral market is] strong and growing at a rate not seen in many years.”

(Dealer 5) “It appears that interest in minerals of the highest caliber is greater than the supply and values are rising . . . I see this as an appreciation for them as works of art and collectibles . . . When compared to the current prices I see in other fields, I am of the opinion that mineral specimens are significantly undervalued . . . I see tremendous growth continuing.”

(Dealer 6) “The Iconic minerals, or best of the best, are getting harder to procure and are in very high demand at ever-increasing prices—[they are] sought by a group of high-end collectors whose numbers seem to be increasing rapidly.”

(Dealer 7) “The mineral market today is stronger than it has ever been in history, and yet in my opinion is still a far cry from where it will be going. There are two very divergent markets currently; one consists of the classic dealers and collectors who have been active for the last 50 years here in the US, and the other consists of the new (and much more affluent) collectors who are interested in the finer levels of collecting and are impressed much more by the artistic side of the mineral kingdom than by the scientific. “The combination is forcing growth and differentiation within the hobby. I feel that minerals in the wholesale categories will always be marketable but without growth or expansion, and I believe the mid-range of minerals will always be there but will as always not turn over quickly. And, of course, the best of the best will continue to demand record prices, will be coveted by all collectors and will greatly appreciate over time. “My belief is that the mineral business is healthy and is still in an emergent stage but will become much more mainstream over the next two decades.”

(Dealer 8) “First impulse is to say [that the mineral market is] healthy and strong, and growing at a rate not seen in many years. However, when one dissects levels of the market, variations are apparent. The low end, let’s say less than $1000 per specimen, is a bit weak. Sales can be strong, but at what most would consider discounted prices. The real problem here is that I don’t really see any growth. We are either not doing enough to grow the hobby, or possibly we are pricing ourselves out of a strong customer base. There is a natural tendency for price escalation, due in large part to growth in the very high-end market. The fault is bipartisan—both from dealers wanting/needing more and from collectors saying ‘Wow, look how expensive that is—holy smokes, look how much my collection is worth!!!’ These developments make it difficult both for older collectors and for new, less affluent or young collectors. The mid-range is still slow, but growing again, I believe. Folks who could afford $5–15k and occasionally $25k1 per specimen got hurt the worst in the recent economic downturn. I think many thought it was time to quit or scale down as they saw their 401k drop. On the plus side, I think that many of them are seeing the price escalations, and are jumping back in.”

(Dealer 9) “Business is great in the upper-end minerals. Numerous collectors are looking for the best of the best. The top-end dealers are looking for these minerals to service the growing number of top-end collectors. Business is harder for the middle and lower-end dealers because of the recession. But business is still there for those who want to work hard.”

(Dealer 10) “A subject that is surely on everyone’s mind is that high-end mineral collecting is becoming more attenuated, a trend that started years ago. In other words, the truly great pieces are increasingly in demand and harder to find. The obvious result is that prices and values continue to increase every year. To a lesser degree this affects the value of all mineral specimens in a positive way. But the gap in values between truly great minerals and lesser pieces seems to be wider than ever. In this regard, collecting minerals is no different from collecting other valuable objects. One thing is constant: the hobby needs new blood. Attracting new collectors young and old is important for collectors and dealers, not only in an economic sense but also to help keep mineral collecting a vibrant and attractive hobby for collectors and investors alike. We are all caretakers of these wonderful and unique objects that need to be carefully preserved for future generations. Another very positive aspect is that collectibles are still one of the best places to park assets, especially in this sluggish economy. In my opinion, top-quality minerals still have not caught up with other collectibles and will only increase in value over time. “On the one hand, this is a golden age for super-quality specimens. The high prices that have been established by the elite dealers have resulted in more aggressive searching, more expensive mining techniques to extract quality specimens, and the development of advanced lab techniques to bring the most out of a specimen. A great example of this is the gem matrix pieces, e.g. Pakistan aquamarines, which blitz older museum pieces. The negative side of this high-quality high-price age is that it is scaring countless future collectors from the hobby. A big problem I see is that some elite dealers and collectors tell everyone that only the very best pieces are worth having while anything with damage or less than perfect composition should be avoided! So where can a modestly funded collector go? Somehow we need to foster new or average collectors and not make them feel they can’t afford to build a worthwhile collection.”

(Dealer 11) “The high end appears to be not only strong, but growing at an accelerating rate.”

(Dealer 12) “There seems to be a shift by many of the newer collectors to minerals that are artistically pleasing rather than just scientifically important, and toward cabinet-size mineral specimens.”

(Dealer 13) “All ranges of minerals appear to be selling. Judging by the quantity of mineral specimens on the Denver Show floor, there are not enough new collectors coming into the hobby. There has been concern for a long time about bringing in the new, young collector . . . At the other end of the spectrum I also see a number of middle-aged to old collectors renewing their youthful interest in rocks and minerals. . . . The value of minerals has increased to the point where many people are deciding to sell [their collections], even long-time dealers. The internet has had a tremendous effect, both on sales volume and on prices. When someone in India or Pakistan can go on the internet and see what retail dealers are advertising specimens for, it can significantly increase the pricing at the source.”

(Dealer 14) “The mineral collecting hobby is slowly beginning to grow again. The financial crisis of 2008 really took many of the middle buyers out of the market. This group has started to emerge from the ashes and is beginning to buy again. This portion of the hobby is very important, as it helps support more dealers. More dealers means more minerals, more people looking for collections, more people looking for sources, and more opportunities for collectors to find rare and fine minerals for their collections. Miners work longer and harder if they can sell their material.

“The best pieces are rare, so it’s important that a market exists for the lower and mid-level minerals in order to finance mining projects long enough for the great material to be found, removed, prepped and finally sold. The upper end of the hobby has taken off in the last seven to ten years as new collectors and investors have entered the hobby. This group appears to be interested in the science, the natural-art aspect, and the uniqueness of each fine mineral specimen. There are also investors interested in diversifying their assets and using fine minerals as one of the means for doing this. I think this trend will continue as more of the world has the opportunities and money to buy finer minerals. The trend can be seen in the increase in buyers from China, Eastern Europe and other emerging areas of the world, and I think that it will continue to drive prices much higher as these parties become more informed and excited and find more opportunities to purchase mineral specimens.

“The best or near-best and the most special specimens have always increased in price the fastest, and I see no reason this shouldn’t continue. Collectors also have the opportunity to acquire great minerals which are in collections being rolled over at this time. Many of the best private collections are held by folks who are entering the stages of life where they want to sell, or their estates want to sell. This creates a great opportunity to obtain the best material from localities that have been closed, in many cases, for decades. This large influx of material should energize the market, as the opportunities to obtain great items bring in more interested parties. This again should create a boom for collectors, as the aggressive sellers, auction houses and mine operators compete for business by presenting the best available material to the market.

“Prices should continue to increase, too, as the best material becomes more highly desired and less available. Where there once were ten collectors who would buy a $100,000 specimen, there are hundreds of people today who spend that amount rather frequently. The number of great mineral specimens is finite. That fact alone creates an aggressive market which has no reason to slow but rather should continue to grow at a faster rate going forward. As I see it, the mineral hobby has plenty of growth potential as more people become exposed to these natural treasures. ”

(Dealer 15) “Mineral prices don’t magically go up. There is a mechanism behind pricing in the mineral world that Adam Smith would be proud of. Our mineral market is not being manipulated by any government, group, or person: something you can’t say about many of our current investment markets. So what is driving the market? Answer: the scarcity of good specimens and the increasing international awareness of mineral collecting. Both are applying great pressure to our market. On the supply side, the world is being squeezed like never before. There used to be thousands of mines, worldwide, with the potential of producing specimens. This is no longer the case. Environmental pressures, high mining costs, restrictions on explosives, exhaustion of oxidized mineral bodies and a host of other issues are slowly decreasing our access to specimen supplies. This trend will not stop. As a matter of fact, it will accelerate; as mines become larger and more mechanized, fewer and fewer mineral treasures will be saved. This same consolidation will push small miners out of the mining business and further pressure supply. With mines closing, and new mineral supplies diminishing, pressure to build good mineral collections increases. Naturally, collection prices are escalating. On the buying side, more and more people of wealth are discovering the mineral hobby. Some have the passion for minerals in addition to the money to chase them, but even those without passion for minerals can see their beauty and enjoy holding them as a store of wealth. This latter issue is a large driving force in the world as people seek tangible assets.

“Adding to the issue of price inflation is the explosion of interest in minerals around the world. It’s not your dad’s hobby any more. The mineral world has grown up. People everywhere are connecting on the internet, going to mineral shows, networking with friends, watching shows . . .the result: more collectors. Many of these collectors can afford to pay whatever it takes to acquire specimens, resulting in ‘higher prices.’ These phenomena are not occurring without a cost to the market. Many long-time collectors are becoming disenfranchised by the high prices and scarcity of the things they once took for granted. Good minerals, let alone great minerals, are becoming priced above what many collectors can afford. This is resulting in a market split. And the split is widening between ‘great minerals’ and ‘everything else.’ The great minerals (those with truly high quality) have been going up 10 to 20 percent per year. The balance of the mineral specimen market is not seeing increases like this, and indeed may be deflating as buyers in the mid-range can’t afford to keep up. The resulting lower prices on this material will encourage new collectors and many existing collectors to stay in the game. Just look at the explosion in internet and auction marketing platforms where there are great bargains to be had! This is an exciting time for the mineral world and I can’t wait to see what happens next.”

COMMENTS FROM COLLECTORS

(Collector 1) “Today’s world feels very different to me than the world of, say, 20 years ago in the sense that the bulk of good material is coming out of collection recyclings rather than as new production from mining ventures. There are a few prolific localities going, such as Milpillas and Inner Mongolia, but most of the high-end material seems to be coming out of old collections. Areas such as Pakistan, Afghanistan, Brazil and China seem to be in decline as compared to just a few years ago. Specimen-mining ventures also seem to be down a bit, although some specimen mines, such as the Adelaide and Rogerley, are going strong or hanging in there. Another difference is the increased use of technology to either free or enhance specimens with some damage. Trimming, repair/restoration, and in extreme cases color enhancement through radiation or heating are now common things to consider when evaluating a specimen for acquisition. This was not so common a couple of decades ago. In my opinion, these factors have contributed to the rise in prices for even mediocre specimens. Decreased availability of high-grade material and the ability to ‘dress the pig’ have skewed the price market. Truly natural, undamaged masterpieces were always rare, but with what I perceive as an increase of high-end collectors able to pay high prices, the great pieces have become even more valuable. These are things I define as unrepaired, un-enhanced, aesthetic minerals. So the buyers have to be much more cautious these days when purchasing ‘the best.’

“Also we have seen the rise of dealers with much more sophisticated business models. In the old days, having a booth at a show with one or two display cases was the mark of a top dealer. Now the way that the minerals are displayed is not unlike the way great art objects are treated. Dealerships also seem to have niches, such as mining ventures, branches in major new markets, or base-making. But some things have stayed the same, among them the importance of maintaining personal relationships between dealers and their best customers.”

(Collector 2) “I’d describe the state of the mineral universe as a truly free market with lots of positive aspects and some negative ones. A lot of folks focus on what they perceive as the negative aspects of free markets. Some folks like to complain about the prices of top-shelf specimens, but in reality the mineral collecting hobby has aspects that can be enjoyed at all price levels.

“Regardless of the level on which we participate, wanting and striving to get to the next level is part of human nature. Lamenting the cost of things just out of reach is a tale as old as time. Still, some collectors are jealous of the top collectors who get access to the best specimens, sometimes nursing hard feelings toward dealers who give preferential treatment to their top customers. To me, this is only a reflection that said collector does not understand business. Most man-made collectibles (stamps, art, baseball cards, coins) have price guides, and enough auction results to reasonably set the market. Minerals are all so unique that auction prices are really valid only that day for that specimen. Those who approach the hobby as investing should realize that, as in the equity market, some pieces will go up, some will go down, and that in the long run, if you buy carefully, your mineral portfolio will likely increase in value.

“I do worry about folks whose sole interest in the hobby lies in ‘playing the market’ with minerals, because for me the wheeling and dealing, while fun, is less important than the broader pursuit of just having fun. We love showing friends (especially kids) our collection. We love looking at objects of natural beauty in our home every day. We love the fellowship of mineral clubs, mineral shows, and mineral friendships most of all. For us the possibility of turning a profit, while certainly an exciting aspect of the hobby, pales in comparison to the life value we glean from experiences and relationships.

“As with any similar endeavor, the most important thing I think collectors should remember is ‘caveat emptor,’ let the buyer beware. A painting, coin, stamp, card, or mineral have almost no intrinsic value. We can’t eat them, wear them, or live in them. They have no earnings, no revenues. Are we in a bubble? Are prices set to skyrocket? Who knows? But if you love the hobby and plan to stay in for the long haul, short-term market fluctuations are little cause for concern.”

(Collector 3) “Collectors seem happy to buy at record prices across the board. Dealers, however, are facing stiff competition for stock. New supplies are always variable in size and quality…it’s not clear how China will be replaced if it runs out of specimen sources. Old collections are another source, but finite in number and highly varied in quality. There seems to be an increasing supply of collections for sale (or at least a number of collectors I know are now selling off their collections) but I think this reflects the collector’s age and his ability to make a significant profit rather than any lack of interest in collecting on his part. [Seeing old collections come up for sale] can be wonderful for a collector, enabling him to get things from localities where the mines are closed and long gone. Even the European classics are now heading to the States, because dealers know that many Americans don’t gasp as loudly from sticker shock.

“The stuff must be selling or the dealers would slow their buying. I think this will only increase the prices offered for established goods. So overall I think that the state is good commercially. I am especially gratified to see younger collectors coming in to take the place of the departing ones. However, the influx of big money has made the dealers more insecure and has ratcheted the level of acrimony to record levels. I think that there has been a steady stream of new collectors at all income levels, but basic rock and mineral clubs are dying out. Also, how does one get it through a dealer’s thick head that nurturing a new mineral collector can mean a steady income for years to come, and that mutual respect can benefit both? With a good, established relationship between high-end collector and dealer you can see business deals evolving, partnerships in mining being created, and financial backing to surge ahead to explore new mineral locales becoming available.

“Unfortunately there are those that prey on the less knowledgeable collectors and ruin what could be a life-long joy. Respect is a huge thing, and you have to earn it, and earn it fairly quickly.”

(Collector 4) “There is a serious risk to hobby growth and specimen preservation if activity doesn’t increase. As a collector who has had considerable experience over the years, here are the divisions I see right now:

“(1) Curio collectors or Rockhounds: casual or low-budget collectors who are attracted to crystal power, trinkets, jewelry making, low-budget lapidary items, and every kindred thing. Theirs is a ‘flea market mentality’ and it is widespread. They have no discernibly deep concern for the scientific aspects of minerals, though they appreciate aesthetics. These people keep the bulk of the average Tucson vendors in business with small, cumulative sales.

“(2) Specialty collectors: serious and knowledgeable collectors who tend to have low budgets or make infrequent purchases. They can find sleepers that the rockhounds miss at shows or mineral auctions. Often they frequent Mindat.com and are capable field collectors. They specialize in localities, chemistry, crystal classes, associations, or whatever. They are motivated by scientific or historical aspects to specimens, and can even look down on big, flashy aesthetic minerals (they describe them as being uninteresting). They can have a superior attitude when discussing the next (more affluent) category. They will spend some good money on specimens, but not consistently. Still, they tend to be the people that dealers cater to regularly, so that cumulative sales to them add up. This consumer base seems to be solid right now but is stagnant. They care about specimen preservation but are clueless or naive (probably by conscious choice) about valuation issues. This crowd resents it when dealers cater to the more affluent group at their expense.

“(3) Connoisseur collectors: serious, knowledgeable collectors who recognize and appreciate science and aesthetics in tandem. They can occur at all price points, but they tend to spend more on individual specimens than the first two groups. This group is growing in the sense that many serious newcomers want to buy the best, as they see such specimens as best representing mineralogy and being the best hedge against inflation. This group cares about specimens holding their value—for all sorts of reasons. Members of this group are highly competitive among themselves, and they buy the best specimens, typically at full retail prices. Dealers are trying to groom everyone to think and spend like connoisseurs, but the truth is that there are probably not enough specimens to go around to build general collections for all of them, so dealers may encourage some degree of specialization to keep everyone happy and engaged in the hobby. The risk is that it seems that not enough new and younger blood is coming into the hobby at the level of budget needed to keep this group growing. A bubble is forming and will burst unless minerals can again recapture the broader appeal that they once held in the public’s eye. High-profile exhibits, museums, and auctions help, but popularizing the hobby widely remains a challenge.”

(Collector 5) “Equity market volatilities, low yields/easy money, corruption (e.g. Greece, Madoff, etc.), and documented alternative asset returns (e.g. auction results, indexes, etc.) are leading more investors to high-end collectible assets. In addition, the substantial growth in the numbers of high-net-worth Asians with their hardasset- minded spending patterns has added fuel to the fire—especially in certain segments (e.g. contemporary art, wine, gemstones and watches). Fine mineral specimens seem to be a relatively new entrant to the collectible asset category; however, they are rapidly gaining traction thanks to improved presentation techniques, publications and TV shows, auction data, gem demand, new museums displays, and general decorative interest (e.g. lamps, tabletop accents, cabinet displays, etc.). In order for minerals to compete with some of the larger collectible categories and not fade out as just an expensive hobby, more transactional data is going to have to be published to reassure new collectors, potential funds, etc., that such assets can provide considerable capital preservation and appreciation.”

(Collector 6) “The top of the market is fine and healthy. Top pieces sell quickly, seemingly for whatever is asked, and these prices are often very high. Lots of dealers feel that their best pieces are worth the top dollars when actually they are nice but not the best (so be careful if you are a high-end buyer). The lower end is very active and pieces sell well and quickly. The middle market seems to me to be languishing; these specimens are not selling well unless priced very fairly, but I feel that they are going to be in greater demand in the future. I think there are more people stretching to buy at the top. This trend has had an upward slope since the early 1990s. Aesthetics has become increasingly important over the same time period. Very few will buy an ‘ugly’ today for top dollars; ‘pretty’ sells the best.”

(Collector 7) “Competition seems intense for the ultra-high-end specimens (as is the case for most of the conventional collectibles)— I think this is true amongst the high-net-worth, aging population, so I wonder whether in the long run this competition, and corresponding price escalation, will continue, or whether we are approaching bubble territory. I believe (much to my chagrin) that included in the competition for the really high-end specimens are dealers who are either snatching these for their personal collections or putting them aside to capture perceived escalating valuations themselves, before collectors ever get a chance to buy or even see such specimens. The higher-end marketplace is then offered the specimens that are ‘almost there’ to satisfy demands\desires for additions to treasured collections.

“On the flip side, dealer stock and fair to upper-middling material seems readily available even with the paucity and difficulty of new finds. I strongly believe educational events such as the Dallas Mineral Collecting Symposium are invaluable to the hobby and potentially can benefit the marketplace. Critical to such an effect is the in-person display of great specimens at the event, or super-photography of great specimens as part of the visual content. I think more such events by other dealers would promote their longer-run future. Also, You-Tubing the Dallas Symposium, with consciousness-raising effects on K-12 administrators\science teachers and even college geology departments, could serve as a wedge for driving the hobby beyond the baby boomers, the old-timers, and the lucky subset of younger folks who had the chance to field collect, or have had some other form of engaging introduction to the hobby.”

(Collector 8) “From what I see, high-end specimens will continue to be valued and desired. I have had too many dealers complain that they cannot get enough really top-end rocks. Lots of megahundred- thousand-dollar rocks are coming to market (even quartz, calcite, gypsum and fluorite; who would have guessed!!) as well as mega-millions (rhodochrosite, tanzanite, gold, silver, ruby, aquamarine, etc.). In the middle, things are sort of stagnant. Prices are not eroding, but also not climbing. Low-end seems good business, with lots of stuff available, new finds in China, etc., so the market is good (even if dealer profits are not so good).”

(Collector 9) “Upper-end is great as the collectors see the prices going up quickly. As prices go up, better specimens come to the market. For middle-range specimens, prices are going up also. The middle-range collector does not have as much available cash so he cannot purchase as many minerals as he purchased before. The lower end of the market has a very large supply which keeps the prices much lower and more affordable. This is great, as these collectors graduate to being middle and upper-end collectors.”

(Collector 10) “For the general collector, today is the golden age of minerals. There are more fine specimens available at the Denver, Tucson and Munich Shows than anywhere else in the world and at any earlier time in history . . . Prices are going up, no question about that, but so are quality and quantity. There are many mining operations just for mineral specimens, which were virtually nonexistent 40 years ago.”

(Collector 11) “Quality and price are going up astronomically on the ‘elite’ specimens, which really are extraordinarily gorgeous and much more numerous than such specimens were 40 years ago. A new cadre of very competitive and very wealthy collectors are vying for the best of the best. But many dealers make the mistake of thinking that, because the prices on the top-end pieces are going up so rapidly, the value of middle-range pieces must be much higher as well, and that’s not always true. People with middle-range incomes aren’t much better off than they were 30 years ago, whereas the people in the top 1% have seen their incomes rise by over 300%, so it’s not surprising that they have more money to spend and invest than the ordinary collector. They also want to diversify their portfolios to include more hard assets, so they are increasingly looking on fine minerals as investments. All that is very distracting to middlerange mineral collectors.

“In reality there are a great many good middle-range minerals on the market at reasonable prices if we just pay attention and search them out, rather than wishing we could buy million-dollar specimens. Even 40 years ago most collectors wouldn’t have been able to afford the elite specimens sold by dealers such as Martin Ehrmann. And today we have the internet for finding specimens and comparing prices. More specimens are available now than ever before, in every price range. These are good times for everybody.”

CONCLUSION

I hope that the comments and opinions presented here are of some interest. The intent is to give the reader a glimpse of what many of the well-respected mineral dealers and collectors think is going on in the mineral hobby/business today. Personally, I found the insights to be both fascinating and enlightening, and the main takeaway for me is that the hobby/business is healthy and growing, and that the interested parties are generally enthusiastic about the future of minerals.

My one suggestion for everyone is to support and reinvigorate the Fine Mineral Trade Association (FMTA), even if it means adjusting its operating goals, methodologies and aspirations to make it more acceptable to everyone. I strongly believe that the FMTA can serve the best interests of all mineral enthusiasts by increasing the credibility of the market and by increasing the general exposure of the mineral hobby/business. In the long run, and if run correctly, the FMTA could help spread the word that there are beautiful and/or interesting minerals that can be purchased and loved by their owners. It is amazing to me how many friends and relatives I have who, when shown beautiful mineral specimens, say that they had not known that such things existed, much less that they could be acquired and appreciated daily.

I want to thank all of the participants who took their time to send me their perspectives and opinions.

Barry M. Kitt

The Pinnacle Collection

bk@pinnaclefund.com